tax return news australia

Your Personal Tax Return Includes Your Business Or Rental Activity Schedule C AndOr E Businesses And Complete Data Is Received By March 15 2022. However if these dates fall on a saturday sunday or legal holiday in any given year the payments are due the next business day.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

This link opens in a new window.

. Federal budget 2 hours ago. 2022 income tax return due for people and organisations who dont have a tax agent or extension of time. 20210913 if your vat period has a 31 may 2022 end date your first vat quarter.

Get your tax refund with one easy phone call. Your Returns Will Be Filed By April 18 2022. Tax returns for individuals and.

The government handed down the 202122 Budget on 11 May 2021 with several changes to tax and superannuation laws see budgetgovau External Link. It will take between 2 and 10 minutes to use this calculator. Is Tax Return Mandatory In Australia.

A tax return should be filed if you earned Australian income from 1 July 2020 to 30 June 2021. CALL 61 4 00944057 or 1300 629 454 within Australia now. Lodge Online with myTax.

2022 income tax return due for people and. Tax season is still in full swing and youve got until 31. Australians lodging their own tax return have just days to submit their income details to the Australian Taxation Office.

17 Aug 2021 QC 16608. Individuals with capital gains over 250000 anytime from January 1 2022 forward are going to be subject to. It can be used for the 201314 to 202021 income years.

Tax return due date 2022 australia. The Australian tax year runs from 1 July to 30 June. Events or timelines may change.

However a corporation may apply to adopt a substitute year of income for example 1 January to 31 December. It is still important to file your taxes even if you have a lot less income this year. The Australian Taxation office ATO has uncovered approximately 291000 cigarettes and 3026kg of loose-leaf tobacco in an operation spanning three properties in Logan Queensland on Wednesday.

Key events for Australian shareholders 2012-13. Heres what you need to know. Tax Return Australia is open 20 hours a day for international and local clients Individuals and Corporates.

A corporation including the head company of a tax consolidated group lodgesfiles a tax return under a self-assessment system that allows the ATO to rely on the. You can choose to prepare and lodge your own return or use a registered tax agent. Interest on early payments and overpayments of tax 2012-13.

Around 10 million Australians will pocket an extra 420 when they lodge their tax returns after July 1 under a plan to increase tax relief for low and middle income earners. First Home Super Saver Scheme increasing the maximum releasable amount to 50000. South Australia 91 Waymouth St Adelaide GPO Box 800 Adelaide 5001.

If a particular tax issue applies to you you are required to file a tax return. Separation of new News Corporation from Twenty-First Century Fox Inc. The february 2022 to april 2022 due dates are as follows.

Australia has no end to the permanent residency program or a time. NSW 100 Market Street Sydney GPO Box 9990 Sydney 2001. A tax return is necessary if any of the following applies to you.

Tax returns must be filed by individuals who earned Australian income from 1 July 2020 to 30 June 2021. From tax cuts to tax returns and every how to you need read all the latest tax advice news and updates. It is possible to lodge your tax return anytime between July 1 st and October 31 st.

Log in to an online service. Tax Return Due Date 2022 Australia. Best Shopping Deals.

It is your responsibility to file your own tax return by the 31 October deadline. Tax return for individuals supplementary section 2012-13. Set up myGov and link to ATO online services.

Home page Australian Taxation Office. ACT Cnr Cameron Ave Chandler St Belconnen GPO Box 9990 Canberra 2601. We guarantee a maximum refund by claiming all possible deductions within the law.

The deadline for your tax return is 12 months after the end of the accounting period it covers. It is still important to file a tax return to determine if you should receive a refund despite a smaller income this year. One of Australias largest banks has been caught charging.

NT 9 Parsons Street Alice Springs 0870. Digicel Group said it is considering legal options after Papua New Guinea PNG imposed a 100 million tax that the telecoms firm said has. If you are ready to file your tax return now we can help you out.

The next phase of the tax cuts will eventually remove the 325 and 37 marginal tax rates which will result in around 94 of Australian taxpayers facing a marginal tax rate of 30 or less in the 202425 and later income years. Listing of individual tax return instructions by year. The tax is effective for 2022.

444pm Oct 29 2021. Tax return for all entities with a lodgment due date of 15 may 2022 if the tax return is not required earlier. Check the progress of your tax return.

An Australian citizen or resident and taxable income was higher than the 18200 minimum for a foreigner and you earned more than 1 in Australia during the period or a foreigner living abroad and taxable income was greater than the 18200 minimum for a. The average tax refund Down Under is AU2600. You earned over 1 in Australia during the period of income taxation according to your tax documentation.

Monthly payroll tax returns are due on the 7th of each month. Get started with your tax return now. The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the.

You are a registered Australian resident and your taxable income was greater than 18200. This calculator helps you to calculate the tax you owe on your taxable income. If you decide to lodge your tax return online using the online ATO service it should take approximately 2 weeks to be processed by the Australian Taxation Office and perhaps an extra week for you to receive.

Fill out this simple online form and our tax experts will be in touch to complete your tax return and help you claim your maximum tax refund in Australia. Advice under development - international issues.

March 2022 Tax Trends Somber Predictions From The Irs For The 2022 Tax Filing Season Wolters Kluwer

Why This Tax Season Is Extra Frustrating Cnn Business

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Is The Irs Holding Tax Refunds In 2022 For Certain Credits Yes

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

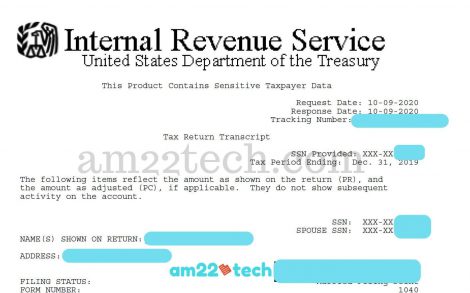

How To Get Irs Tax Transcript Online For I 485 Filing Usa

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Haven T Lodged Your Tax Return Yet October 31st Is Usually The Last Date Of Lodging Your Tax Return By Your International Students Tax Return Student

Scott Morrison Talks Up Tax Cuts As Pressure Builds On Petrol Prices Australian Politics The Guardian

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Income Tax News Research And Analysis The Conversation Page 1

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Tax 2021 All The Dates You Need To Know To Avoid 1 110 Fine

Why This Tax Season Is Extra Frustrating Cnn Business

What Are The Basic Tax Returns In Australia Income Tax Return Tax Refund Tax Return

Income Tax News Research And Analysis The Conversation Page 1

Tax Time 2020 Australian Tax Office Reveals How To Get The Most From Your Return 7news Youtube